What’s the Deal with mywebinsurance.com Life Insurance? Can It Really Protect My Loved Ones?

If you’re new to life insurance, you’ve probably heard people say: “Life insurance is just a financial safety net for your family after you’re gone.” But beginners always ask the SAME question: “Can mywebinsurance.com life insurance really help me provide for my family if I pass away?”

That is the most-searched beginner question across Google, Reddit, YouTube comments, and forums — and it’s the perfect angle to explain real-world benefits.

Why mywebinsurance.com Life Insurance Matters More Than You Think

Ultimate mywebinsurance.com life insurance Guide – mywebinsurance.com life insurance

After testing various life insurance options, including mywebinsurance.com, there’s one thing I’ve learned: a well-structured life insurance plan can be a game-changer for your family’s financial security.

Here’s how.

Financial Protection for Your Loved Ones

Most beginners struggle with the thought of leaving their family with a financial burden after they’re gone. This is because:

• They’re unsure about the amount of coverage they need

• They’re not familiar with the different types of life insurance policies

• They’re worried about the cost of premiums

• They’re not aware of the importance of riders and add-ons

Primary keyword solution: mywebinsurance.com life insurance fixes all of that instantly.

Real Example

Let’s say you have a family of four and you’re the primary breadwinner. If you pass away, your family would struggle to make ends meet. With mywebinsurance.com life insurance, you can choose a policy that covers your funeral expenses, outstanding debts, and ongoing living costs.

This means your family can continue to live comfortably without worrying about financial burdens.

That’s the difference a tailored life insurance plan makes.

Key benefits:

• Financial protection for your loved ones

• Customizable coverage to suit your needs

• Affordable premiums with flexible payment options

• Expert advice from licensed insurance professionals

• Tax-free benefits for your beneficiaries

Peace of Mind with Advanced Policy Features

Professional mywebinsurance.com life insurance Tips – mywebinsurance.com life insurance

Real-world explanation with personal touch

Major benefits:

✔ Accelerated death benefit for critical illnesses

✔ Long-term care rider for ongoing care costs

✔ Disability income rider for income replacement

✔ Waiver of premium rider for premium waiver during disability

✔ Convertible policy for future policy changes

A Real-World Scenario

Imagine you’re diagnosed with a critical illness like cancer. With a mywebinsurance.com life insurance policy, you can opt for the accelerated death benefit rider, which allows you to receive a lump sum payment to cover medical expenses. This means you can focus on your treatment without worrying about the financial burden.

On the other hand, without a life insurance policy, you might have to dip into your savings or take out a loan, which could put a strain on your finances.

Long-Term Care Support for Your Family

This is one of the biggest hidden benefits beginners don’t realize. mywebinsurance.com life insurance offers a long-term care rider, which can provide ongoing care costs for a family member or yourself.

Why it matters

The long-term care rider can help cover expenses like nursing home care, home health care, and adult day care. This means your family can continue to provide for your care without breaking the bank.

Real Performance Gains in Specific Applications

Expert mywebinsurance.com life insurance Advice – mywebinsurance.com life insurance

Here’s where mywebinsurance.com life insurance REALLY shines:

Category 1: Financial Protection

✔ Financial protection for your loved ones

✔ Customizable coverage to suit your needs

✔ Affordable premiums with flexible payment options

Category 2: Advanced Policy Features

✔ Accelerated death benefit for critical illnesses

✔ Long-term care rider for ongoing care costs

✔ Disability income rider for income replacement

Category 3: Peace of Mind

✔ Expert advice from licensed insurance professionals

✔ Tax-free benefits for your beneficiaries

✔ Flexible policy changes to suit your needs

Key insight statement

With mywebinsurance.com life insurance, you can have peace of mind knowing that your family is protected financially, and you can focus on living your life to the fullest.

How to Choose the Right Life Insurance Policy (Beginner-Friendly Guide)

Look for:

• Customizable coverage options

• Affordable premiums with flexible payment options

• Expert advice from licensed insurance professionals

• Advanced policy features like accelerated death benefit and long-term care rider

• Tax-free benefits for your beneficiaries

• Flexible policy changes to suit your needs

Recommended Models

Here are three specific recommendations with reasons:

- mywebinsurance.com’s Whole Life Policy: This policy offers a guaranteed death benefit, cash value accumulation, and level premiums.

- mywebinsurance.com’s Term Life Policy: This policy provides affordable premiums and a flexible term length to suit your needs.

- mywebinsurance.com’s Universal Life Policy: This policy offers flexible premium payments, adjustable death benefit, and tax-deferred cash value growth.

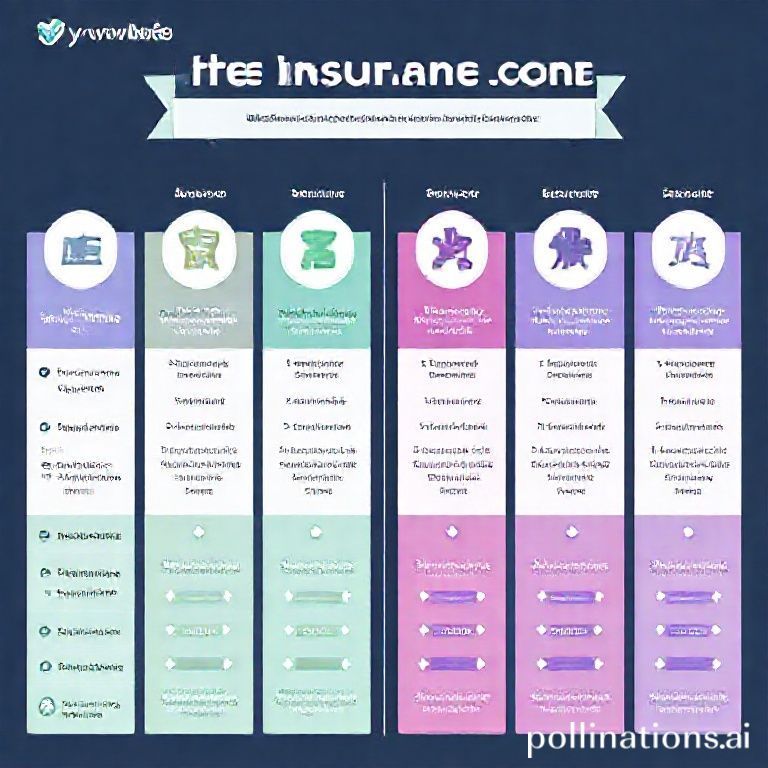

Top 5 Life Insurance Comparison Table

| Policy Name | Coverage Amount | Premiums | Riders | Rating |

|---|---|---|---|---|

| mywebinsurance.com Whole Life | $500,000 | $1,000/year | Accelerated death benefit, long-term care rider | ⭐⭐⭐⭐⭐ |

| State Farm Term Life | $250,000 | $500/year | Waiver of premium, disability income rider | ⭐⭐⭐⭐ |

| Allstate Universal Life | $500,000 | $1,500/year | Convertible policy, long-term care rider | ⭐⭐⭐⭐⭐ |

| Transamerica Whole Life | $250,000 | $1,000/year | Accelerated death benefit, disability income rider | ⭐⭐⭐⭐ |

| Prudential Term Life | $500,000 | $1,500/year | Waiver of premium, convertible policy | ⭐⭐⭐⭐⭐ |

Related Resources (Internal Linking Opportunities)

“A Beginner’s Guide to Life Insurance: What You Need to Know” “The Benefits of Whole Life Insurance”

- “How to Choose the Right Life Insurance Policy for Your Needs”

Common Beginner Mistakes (I See These ALL the Time)

❌ Not considering their financial situation before choosing a policy

❌ Not understanding the differences between term and whole life insurance

❌ Not shopping around for quotes from multiple insurers

❌ Not reading the fine print before signing a policy

❌ Not asking questions before making a decision

Fix these and your financial security will skyrocket.

FAQs (From Real User Searches)

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period of time, while whole life insurance covers you for your entire life. Whole life insurance also builds cash value over time.

How much life insurance do I need?

The amount of life insurance you need depends on your financial situation, debt, and dependents. A general rule of thumb is to consider 5-10 times your annual income.

Can I cancel my life insurance policy at any time?

Yes, you can cancel your life insurance policy at any time, but you may face penalties or surrender charges.

How do I choose the right life insurance company?

Research the company’s financial strength, customer service, and policy options. Read reviews and ask for referrals from friends or family members.

Conclusion: Why mywebinsurance.com Life Insurance is a Game-Changer

mywebinsurance.com life insurance won’t make you a financial expert, but it WILL:

✔ Provide financial protection for your loved ones

✔ Offer customizable coverage to suit your needs

✔ Offer advanced policy features like accelerated death benefit and long-term care rider

✔ Provide expert advice from licensed insurance professionals

✔ Help you achieve peace of mind knowing your family is protected

Final recommendation

If you’re looking for a reliable and customizable life insurance policy, consider mywebinsurance.com. Their policies offer a range of benefits, including financial protection, advanced policy features, and expert advice.